Financial Analysis

Petroleum Distribution Company

(July 2024)

Background

The Client is a Private Limited Liability company having businesses diversity in Petroleum Products distribution in a number of East Africa countries.

Challenge

The company expanded rapidly in the market. However, lacked expertise and effective tools for accurate real-time financial analysis and scenario planning. Thus, the company sought an analysis of its financial performance.

Solution

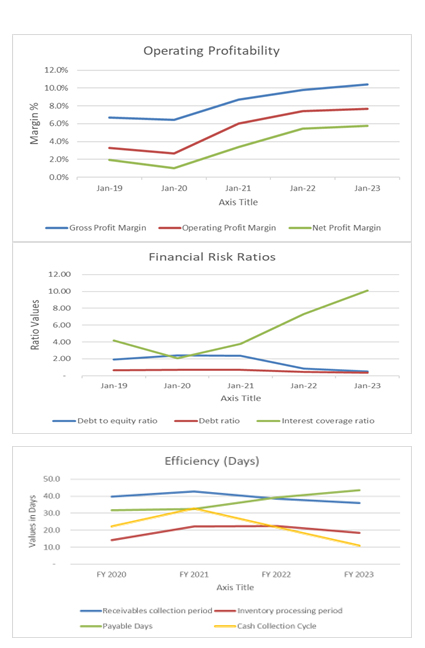

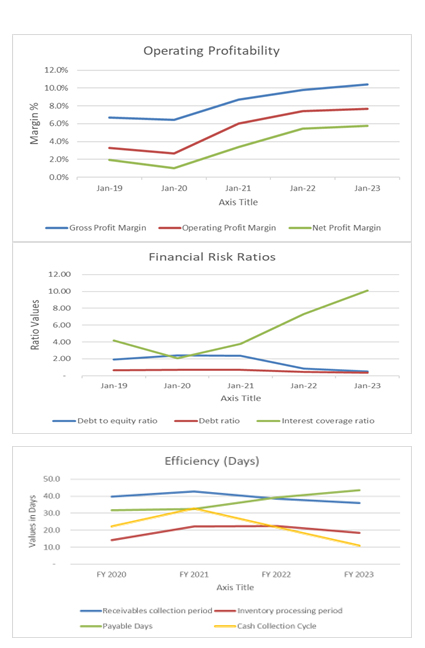

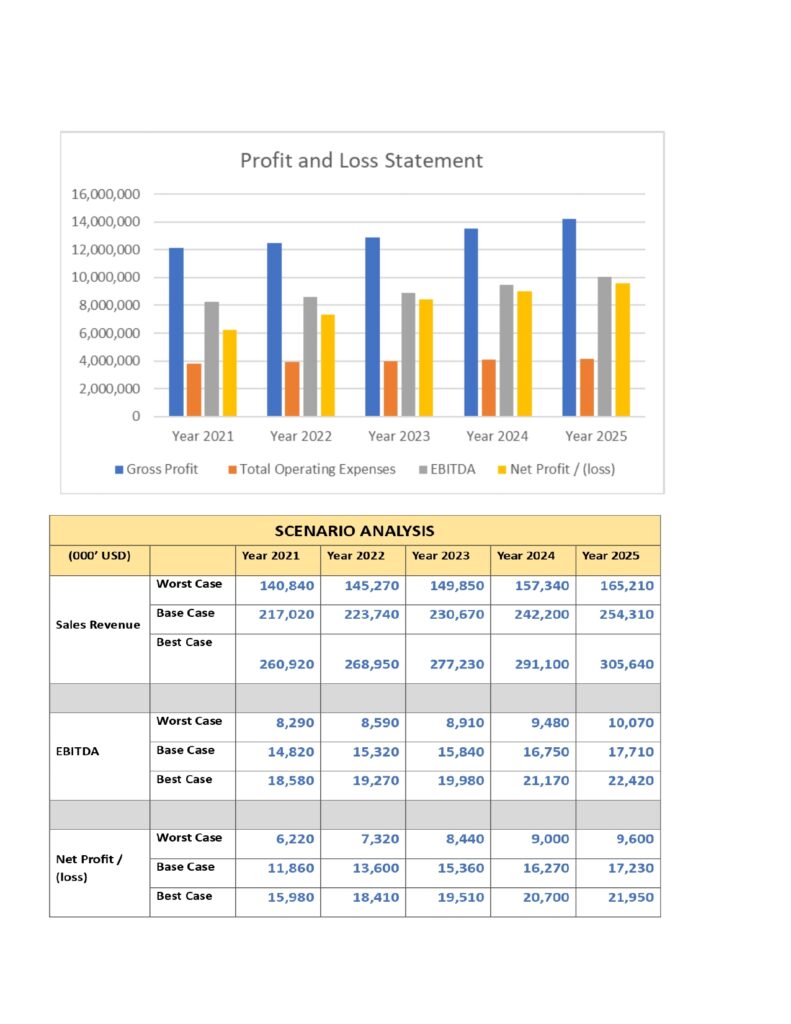

An analysis was conducted to assess the company's overall financial performance.The approach used includes examining the audited financial statements of the company for the most recent 5 years shedding light on essential indicators such as revenue growth, profitability ratios, liquidity position, and efficiency metrics.

Results

With this detailed analysis, the client gained enhanced visibility and control over the financial performance of their business. The company's overall performance was deemed satisfactory. However, significant potential for future improvements was identified. The investigation highlighted several factors impacting the financial performance, including sales volume, cost of goods sold, expenses, and components of the cash conversion cycle. Particularly important factors noted were the level of Sales Volume generated, the Cost of Goods Sold, and Receivables management.

Financial Model and Valuation

LOC East Africa LLC

(June 2024)

Background

The Client is a Private Limited Liability company having businesses diversity in Petroleum Products distribution in a number of East Africa countries.

Challenge

The company expanded rapidly in the market. However, the owners had not have the opportunity to assess the current market value of the business. Thus, the owners sought to conduct a valuation to determine an objective estimate of the fair value of the company.

Solution

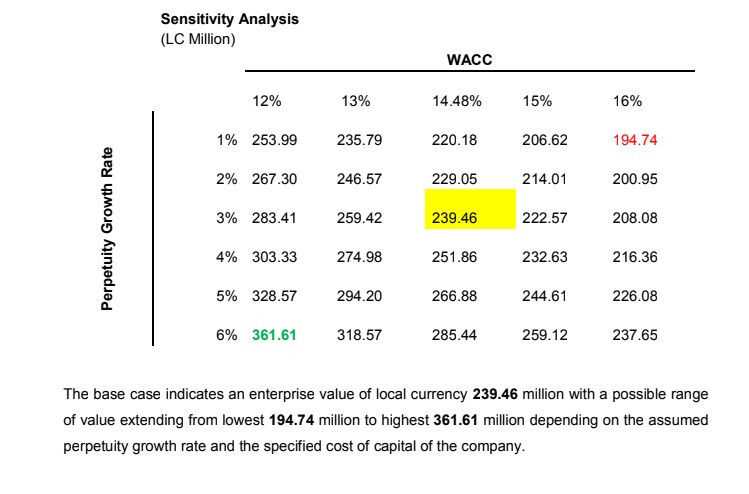

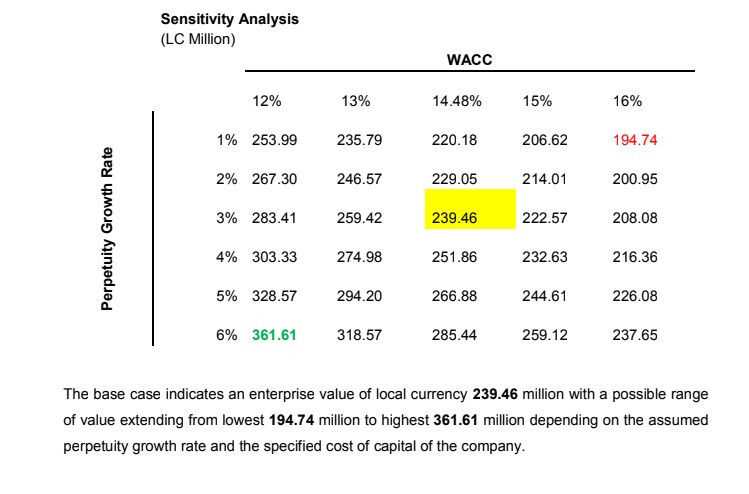

The approach used to prepare for the valuation exercise includes examining the audited financial statements of the company for the most recent 5 years then produce projected three financial statements for the future 5 years following the specified valuation date. The estimated value of the business was calculated using the discounted cash flow method, leveraging cash flows from the projected financial statements. Sensitivity analysis was conducted to determine how changes in critical input variables affect the estimated value of the company.

Results

The estimated enterprise value of the company amounted to 239.46 million in local currency. The sensitivity analysis revealed a possible value range from a lowest of 194.74 million to a highest of 361.61 million in local currency.

The overall outcome of the exercise has empowered the client to pursue future strategic business plans to maintain a competitive edge in the market.

Business Plan

Veterinary Service Center

(March 2024)

Opportunity

Recognizing a significant disparity between the animal population and the number of veterinary service centers in the Sultanate of Oman, investors sought a business plan for establishing a new veterinary service center. The investors were seeking $30,000 in funding.

Solution:

A comprehensive business plan was developed for potential investors. The plan projected a first-year revenue of $130,000, with an anticipated annual increase of 3%. Direct costs were estimated to be an average of 37% of revenue, with a targeted net profit of 20% on sales.

Business Plan

Bunker Fuel Services

(October 2020)

Background

Following a pre-feasibility study, an investor registered "ABC Bunkering" to provide bunkering services and related supplies in Sudan's marine ports. The investor required a business plan to raise USD 9,500,000 for capital equipment and USD 6,400,000 for initial product inventory.

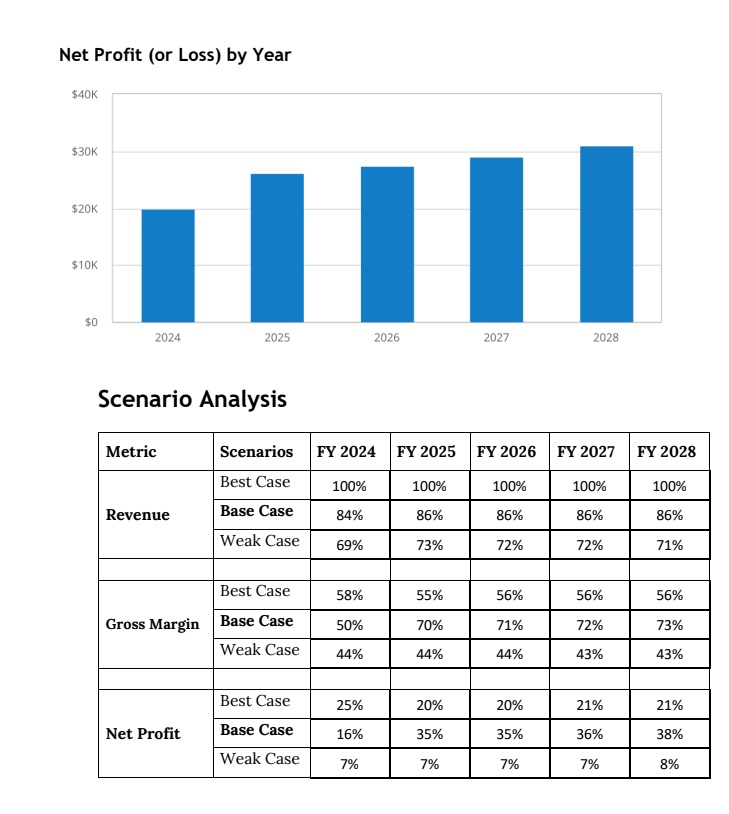

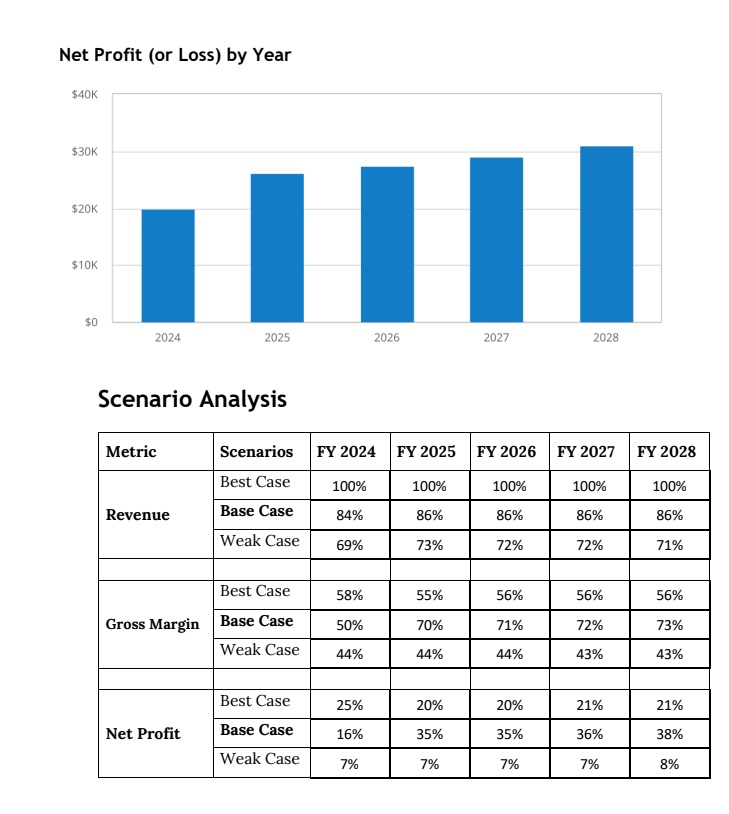

Solution

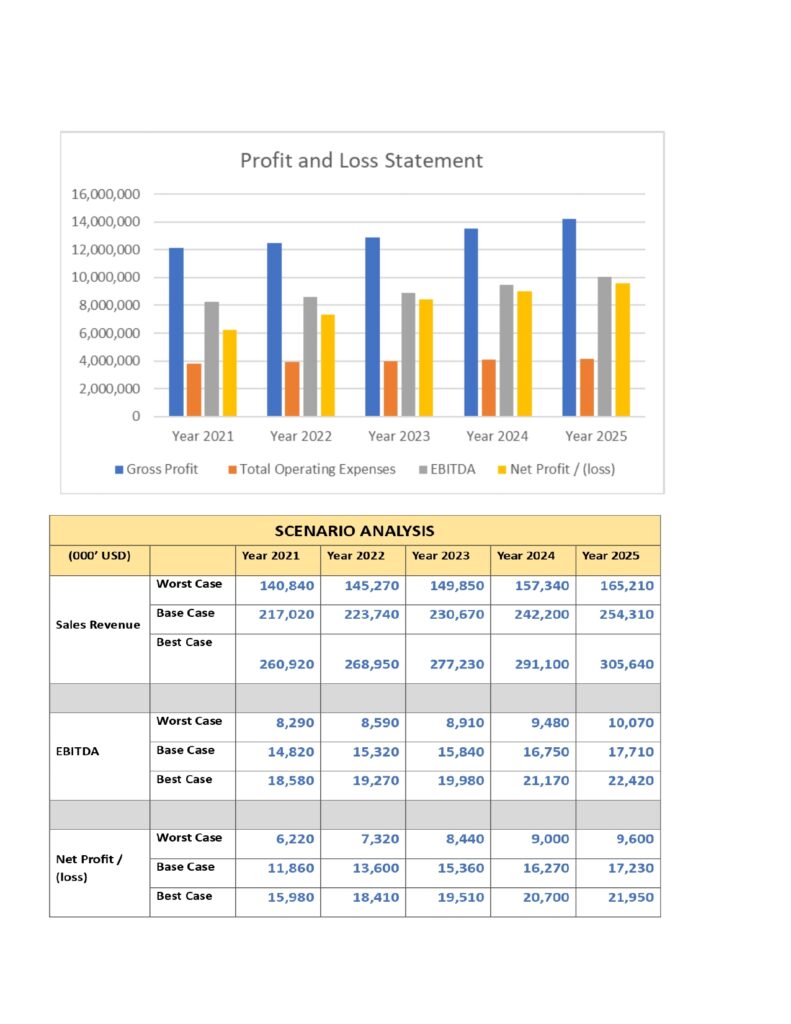

A comprehensive business plan was developed to outline expected financials and operations over the next five years. Three scenarios (Base Case, Worst Case, and Best Case) were created, illustrating sales volumes based on ship traffic, the percentage of visiting ships ordering fuel, and the average refueling volume per ship.

Results

The projected Net Profit Margin in the Worst-Case scenario ranged from 39% by the end of year one to 60% by the end of year five.

Feasibility Study

Veterinary Service Center

(January 2020)

Background

A colleague requested a feasibility study for establishing a veterinary service center in the Sultanate of Oman, noting the low number of existing centers relative to the animal population.

Solution

A feasibility study was conducted to assess the viability of a veterinary service center offering a comprehensive range of services, including general examinations, treatment of ailments, surgery, and emergency medical care. The total project cost was estimated at OMR 13,500, with OMR 10,900 for capital costs and OMR 2,600 for working capital. The project was planned for 100% equity financing.

Results

The project's Net Present Value (NPV) was calculated to be approximately OMR 8,400, with an Internal Rate of Return (IRR) of 51.6% and a payback period of 2 years.

Pre-Feasibility Study

Aviation Fuel Service Market Entry

(May 2019)

Background

The owners of XYZ-Sudan sought an indicative assessment of the economic feasibility for entering the aviation fuel into-plane services in Sudan.

Solution

A pre-feasibility study was conducted using both desk research analysis and primary data from interviews with market players and regulatory bodies in the aviation fuels industry.

Results

- The study indicated a clear challenge to entering this segment of the oil products distribution market in Sudan. The market size was found to be very small, representing approximately 3% of the country's annual total petroleum product demand. Furthermore, there were already six competitors in the market, with three of them holding a combined market share of over 90% and operating in a semi-monopolistic setup.